How to Buy a House in a Super Competitive Market

- By Bill Allen

- •

- 05 Jul, 2016

- •

This is a great article written by Tyler Harman, who is a Los Angeles real estate agent focusing on the hottest and busiest areas of Los Angeles including Highland Park, Eagle Rock, Los Feliz, etc. I think his points conenside with Boulder's market as well.

When homes sell in minutes and accept offers way over list price, how do you stand a chance? I work in one of the most competitive markets in the country and have seen how frustrated buyers can become. After seeing a few horror stories myself, here are five tips that will help manage expectations (for both buyers and agents) and make their journey smoother and more enjoyable.

The Learning Curve

In this new age of technology, buyers are drowning in information and starving for wisdom. The majority of buyers I work with today have done their homework, but unfortunately, they did all the work before the first day of class. As a buyer, you need to learn how to utilize your agent, your lender, your inspectors, etc., to get the information and guidance you need. Now, this isn’t to say you can’t get to the finish line all by yourself, but you’re going to wind up with a lot more gray hairs.

Obsession with Comps

In the market where I work (Los Angeles), I separate my buyer clients into two categories: New buyers and veteran buyers. A new buyer will ask questions like, “What are the comparable sales in this area?” “Isn’t that house overpriced?” “What do you think it will sell for?” New buyers want to know the exact “fair market value” of a home and not pay a penny over that amount.

A veteran buyer will ask questions like, “What do the sellers need from us?” and “What will it take to get this home?” They’ve gone through the romance of the process, written offers, and lost many times before. They’re tired of playing “arts and crafts” (writing offers) and ready to actually buy a home.

At the end of the day, one of these people will end up with a new house. The other will end up with an appraisal. Which one would you rather have?

Leverage Your Agent

As a buyer, your agent might know the listing agent and have insight about how they operate. Even though the seller is calling the shots, the agent will find ways to add their flavor to the negotiations. Every agent has his strong suit, so make sure you leverage it as a buyer.

For example: Are they good at numbers and finance? Have them use that skill when writing offers and communicating that value with the other side. Are they funny and likeable? Make sure they’re on the phone with the other side as much as possible building a relationship. It really isn’t about “playing hardball.” All things being equal, people do business with people they like.

Oh, and let’s talk about the “Listing Agent Groupies.” These are buyers who go straight to the listing agent. It sounds good because the agent gets a big incentive to “double end” the deal and increase their income. But just so you know, the agent’s allegiance is to their seller. Also, in a competitive market, you’ll find fewer and fewer listing agents who want to represent a buyer.

My advice: Find an agent you trust and would like to represent you throughout the entire process.

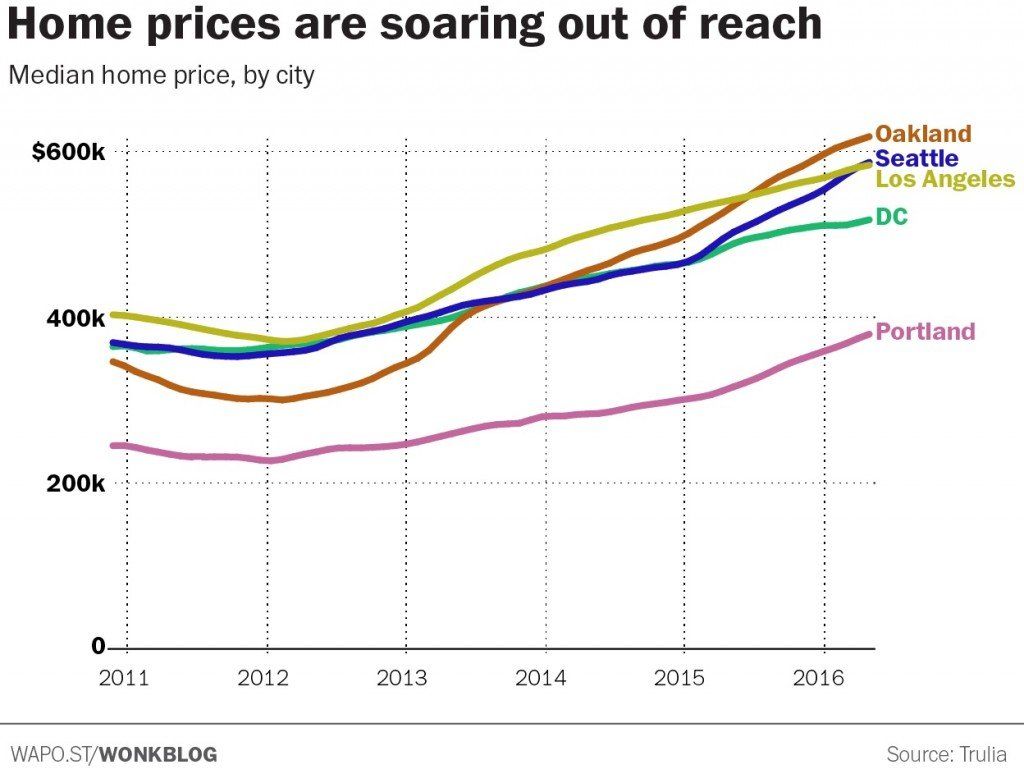

The Disappearing Price Range

In a very hot market, you can almost see the prices moving upwards. For example, in 2014, an online brokerage named Eagle Rock, Los Angeles the No. 2 most popular neighborhood in the entire country. Later that year, we heard people say things like, “One of the last homes under $500,000.” As you might imagine, that home didn’t stay on the market very long and probably sold for well over $500,000.

If that was your budget, you were an “endangered species” and would soon find yourself completely priced out of the market. When that happens, you either raise your budget or you find a new place to look.

Expect Issues during Your Transaction

When it comes to buying and selling real estate, there is one thing that I am sure of: there will be issues. I can almost guarantee that at one point of the transaction, the whole thing will be hanging by a thread. This is very common and is almost expected. (You’ve been warned.) Just like on an airplane, keep your seatbelt buckled because there will be turbulence. When things get bumpy, look to your agent for advice or even to simply hear someone say that everything is going to be OK.

Now, you might hear other agents talk about a smooth transaction, but just know that phrase is relative. A smooth transaction to a real estate agent might be a deal that closes and the house is still standing afterwards. Your definition might be a little different.

Obviously there are a million other tips that we could go into about buying in a competitive market, but the main takeaways here are to be reasonable, roll with the punches, and work together with your agent. Most agents live and breathe real estate, so hold them close as your most valuable resource.

In the Washington Post last week, writer Emily Badger wrote about an interesting situation occuring in Los Angeles. Second units on single family lots are becoming increasingly popular in cities that have limited housing options with dramatically rising prices.

Those that were given permission to build won’t be given certificate of occupancy, therefore they can’t be added to public services, like the power grid. This has left some with living off of extention cords to the main house. All this after a lawsuit was brought against the city

Proponants say it can ease housing shortages and yeild more affordable houseing that won’t cost the city anything. It have help aging baby boomers and still-at-home millennials too.

Protesters say that these 2nd homes (LA’s rules stating can be no larger than 1200 sqft) change the feel of single family home neighborhoods. There will be too many people and less parking. They also fear more people in smaller homes would create a kind of affordable housing among expensive LA real estate.

The city of Los Angeles says that the issues should be resolved by the years end but many people still hang in limbo until that happens.

Here’s a great article written by Re/Max of Boulder’s own Haley Robinson. Enjoy!

Staging will highlight the strengths and downplay the weaknesses of you home and, if done right, will appeal to the greatest number of buyers.

Here are just a few hints on how to stage your home for sale.

Declutter and Clean

This is the absolute most important thing you can do to stage your home. Depending on how you live, I tell my clients to remove 50% of whatever is in view when you walk into a room. That’s books on the book shelves, art, things on counters, bedside tables, office desks, etc. Take those things and pack them in boxes or find it a new home in a cabinet or drawer.

Cleaning seems like an obvious one but I always reiterate it with my clients. When someone comes for a showing, there shouldn’t be baskets of laundry, food sitting out, unmade beds or really any proof that you were just there in the home. Also, organizing all cabinets, closets, and drawers, as people usually want to look inside. It should be in show ready condition for every showing, which can be difficult and stressful especially if you have kids and/or pets.

It also includes a deep clean. Dusting is very important as well as washed cabinets in the kitchen and all bathrooms, washed walls, clean toilets and showers, washed baseboards, and so on.

Depersonalize

When there is a showing in your house, the clients walk in and immediately they ask themselves, “Can I see myself living in this home?” And it’s 10 times harder for them to answer “yes” if they are staring at your family portrait over the fireplace or the kid’s drawings on the fridge. Depersonalizing your home will make room for the idea of someone else living there.

It’s not only framed family pictures but also fridge magnets, wall hangings, large art pieces, magazines, calendars, mail piles, and so on. This can also include political and/or religious objects. While it’s not my job to snuff out a clients personal beliefs, I encourage neutrality as much as the client is willing do.

This can sometimes be emotional for the homeowner. I try to prepare my clients that they may find themselves upset or sad during this step. It’s really the first step in saying good bye to your current home and, for some, it can be difficult.

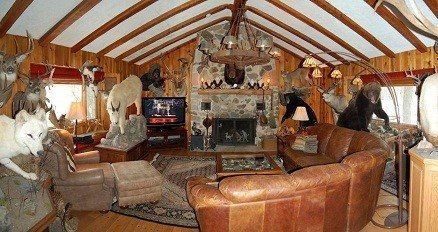

Neutrality

This kind of falls into the depersonalization as well. That lovely floral wall paper, that bold rug, that bright bed comforter may be what you love most but to a potential buyer, it’s all they can see. They don’t see the great light coming in through the extra large double paned windows, all they see is the shade of green that the room is painted and how much they hate the color green. They don’t notice the open floor plan, all they see is the stuffed moose head. These are extreme examples but you get my point.

Getting your home neutral is important for visual people so they can actually see the home and it’s great potential. This may require repainting a room, changing the décor or even adding items like a lamp for extra light or a neutral rug to help brighten a dark wood floor.

Safety

This is my least favorite but most important topic to cover. We like to think of most people as good and honest but there are some jerks out there. Desperate and/or bad people come to open houses and showings, so with that in mind, certain steps need to be taken.

All expensive items, like jewelry, cash, etc, need to be put in a safe, inaccessible place. This also goes for any prescription drugs. I have personally caught someone elbow deep in a drawer containing prescription meds. The owners didn’t lock them up and it gave this person the opportunity to try and steal from them. Most important, all firearms need to be locked, put away with the ammo elsewhere, and preferably taken out of the home to another location. This can also include other weapons/art like bows, spears and the like.

Lastly, for fun, here are some actual, honest-to-goodness photos of homes for sale pulled from the MLS from around the country. Names and cities have been changed to protect the innocent…

A GREAT article by fellow Realtor Jay Kalinski! If you you are thinking of buying or selling the near future, read this article!

As predicted, the Federal Reserve raised interest rates in December, and conventional mortgage rates have increased from 3.625 percent on Nov. 4 to 4.375 percent as of the writing of this article (an increase of 0.75 percentage points). In 2017, economists predict a couple more interest-rate increases to the Fed funds rate, which will likely spur increases in conventional mortgage rates as well.

To a homebuyer in the Boulder Valley, what do these projected mortgage-rate increases actually mean? The effect may be bigger than you would think.

The 1 Percent = 10 Percent Rule

As a rule of thumb, for each 1 percent increase in mortgage rates, your buying power decreases about 10 percent. To understand the import of this, it is helpful to use a couple of examples that buyers in the Boulder Valley might face:

Scenario 1: Looking in Longmont

A couple would like to buy an average single-family home in Longmont, which costs about $400,000. They have about $80,000 (or 20 percent) saved as a down payment and meet with a lender, where they learn that they qualify for a maximum principal and interest payment of $1,600 per month.

If the current interest rate is 4 percent, then their monthly principal and interest payment would be about $1,528, and they would qualify to buy the house. (They could qualify up to $420,000 in the case of a bidding war.)

If, however, the interest rate increased to 5 percent, then the monthly principal and interest would increase to $1,718, and they would not qualify to buy the home. In fact, at this new interest rate, they would qualify to purchase only a $377,000 home (principal and interest of $1,595).

For this couple, a 1 percent increase resulted in a decreased purchase power of about 10.2 percent.

Scenario 2: Looking in Boulder

A couple would like to buy an average single-family home in Boulder, which costs about $1 million. They have about $200,000 (or 20 percent) saved as a down payment and meet with a lender, where they learn that they will need a jumbo loan, and that they qualify for a maximum principal and interest payment of $4,000 per month. (A jumbo loan is one that exceeds the conforming loan limits set by the Federal Housing Finance Agency, which, in Boulder County is $479,950.)

If the current interest rate is 4 percent, then their monthly principal and interest payment would be about $3,820, and they would be able to buy the house. (They could qualify up to $1,050,000 in the case of a bidding war.)

If, however, the interest rate increased to 5 percent, then the monthly principal and interest would increase to $4,295, and they would not qualify to buy the average home. In fact, at this new interest rate, they would qualify to purchase only a $945,000 home (principal and interest of $4,000).

For this couple, a 1 percent increase resulted in a decreased purchase power of 10 percent.

Price appreciation

The above scenarios consider only increasing interest rates. When you factor in price appreciation, which was roughly 15 percent last year for single-family homes in Boulder County, it increases the magnitude of lost purchasing power for buyers.

The Bottom Line

Many buyers in the Boulder Valley have felt a sense of urgency in the past several years, given the quickly appreciating housing market. The prediction of increasing interest rates and, therefore, decreasing purchasing power, will likely add further pressure to buyers to purchase a home quickly before they are priced out of the homes they desire.

Jay Kalinski is broker/owner of Re/Max of Boulder.